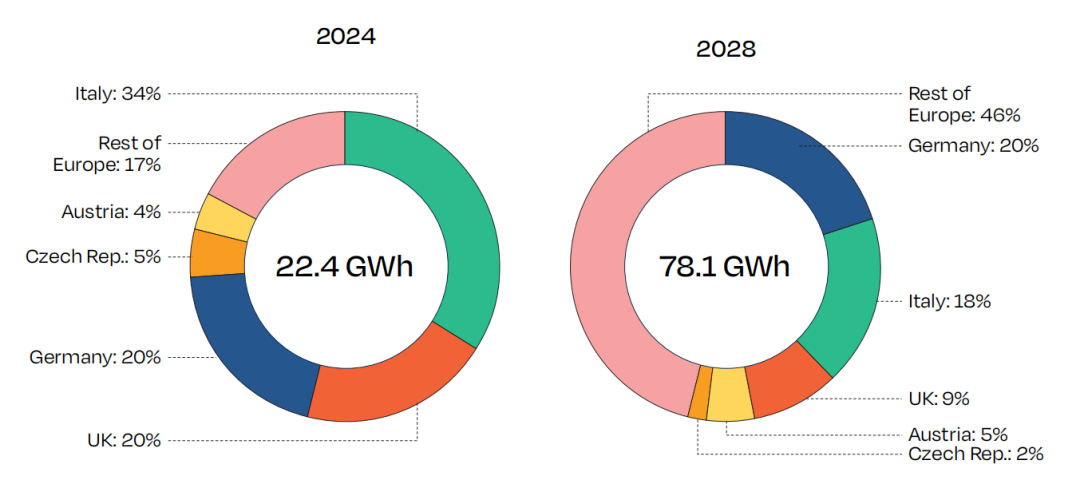

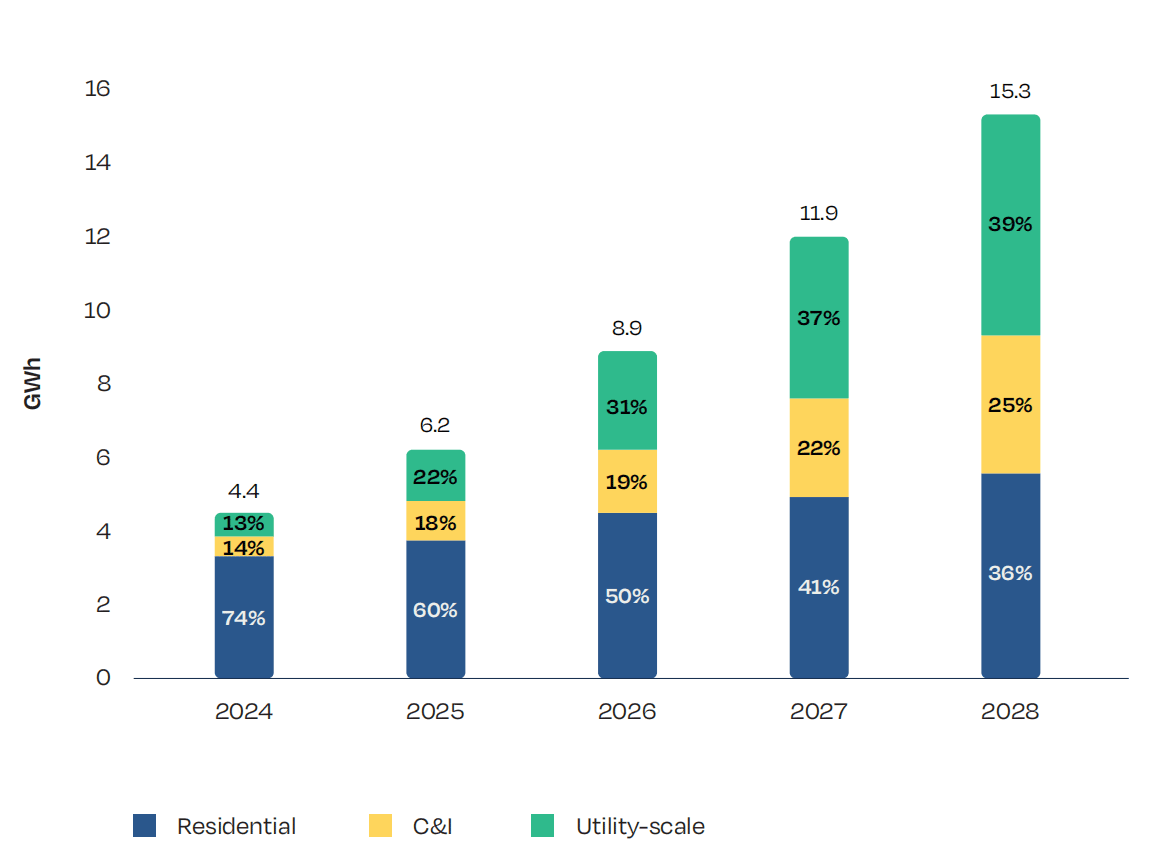

For a long time, Germany has been the boss of the European energy storage market! 2024, the former “big brother” was overtaken by Italy and the United Kingdom, falling to the third position! 24 years, Germany is expected to add 4.4 GWh of new installations, a year-on-year decline of 14%, accounting for 20% of the total installed capacity in Europe.

01 Household reserves plummet 36%

The German market is dominated by household storage. After the last round of explosive growth, 3.26GWh of household storage was installed in 2024, a decline of 36%. This was mainly driven by a slowdown in household PV. 2023 saw a record high of 62.8GW of installed PV in Europe, while 2024 saw a growth rate of just 4.4%, the lowest rate since 2017. This is a 92% drop from the consecutive double-digit growth in 2021-2023!

But Germany remains the best household storage market in Europe, bar none! The rate of new PV storage allocation in Germany remains above 80%. In addition, many PV systems installed around 2000 will require storage to increase their revenues as the 20-year feed-in subsidy expires. New demand in the storage market is starting to emerge.

Other favorable factors in the German household storage market include:

1, due to overcapacity and technological advances, battery prices remain low, the economics of household storage and arbitrage opportunities to further improve;

2, Community energy storage and aggregated energy storage are on the rise across Germany.

3, Electrification progress and retrofit rate increase.

4. The regulatory framework will be further improved. This includes the highly anticipated “Solar Package 1” bill, which will ensure that 22GW of PV will be installed annually by 2026 and remove barriers to deployment. As well as the introduction of the “Electricity Storage Law”, the first draft of which was published late last year and which still needs to be improved.

Taken together, the German household storage market is expected to recover in 2025 and exceed the 5 GWh mark again by 2028!

02 Significant growth in commercial and industrial reserves

The German commercial and industrial storage market is expected to grow significantly over the next five years!

In 2024, 612 MWh of new commercial and industrial storage is installed in Germany, representing a market share of 14%. Although the installed capacity is less than one-fifth of that of household storage, this makes it easy for companies to self-generate and self-consume as the economics of C&I storage improve and regulatory conditions improve. Many companies have targeted this track, and C&I storage products have become better and cheaper. Simultaneous liberalization of market access for arbitrage and balancing services will strongly protect the growth of C&I storage.

By 2028, the German C&I storage market is expected to soar to 3.8 GWh. six times more than in 24 years!

03 Bright prospects for large reserves

In 2024, the installed capacity of large storage in Germany is 553 MWh, with a market share of 13%. The large storage market shows a very bright future.

The FCR market (frequency balancing) is the main source of revenue for storage operators, but as the market becomes saturated, operators are entering the secondary (aFRR) and tertiary (mFRR) balancing control markets. In addition, operators can arbitrage energy in the wholesale market. Capacity auctions, on the other hand, have yet to meet investor expectations. The main obstacle is that energy storage systems can only store electricity from renewable sources and cannot recharge from the grid in the event of negative tariffs. This undermines the attractiveness of developing energy storage systems.

In addition, the government is set to liberalize the capacity market, balancing and restoration services, and other ancillary markets such as voltage control. In this scenario, the large storage market is expected to grow significantly, with installed capacity soaring to 6 GWh by 2028, increasing the market share from 13% to 39%. and will bring Germany back to the position of European boss!

04 Outlook 2025-2028

Germany accounts for 20% of the overall European energy storage market in 2024. Looking forward to 2025, it is expected to grow by 40% overall to reach an installed capacity of 6.2 GWh, slightly behind the UK, ranking second in Europe. Of this, household storage is expected to have an installed capacity of 3.72 GWh, a small increase. Commercial and industrial storage 1.12 GWh, nearly doubled. Large storage 1.36 GWh, nearly tripled, accounting for 22%.

Germany’s installed energy storage capacity is expected to reach 15.3 GWh by 2028, contributing to 20% of Europe’s installed capacity.