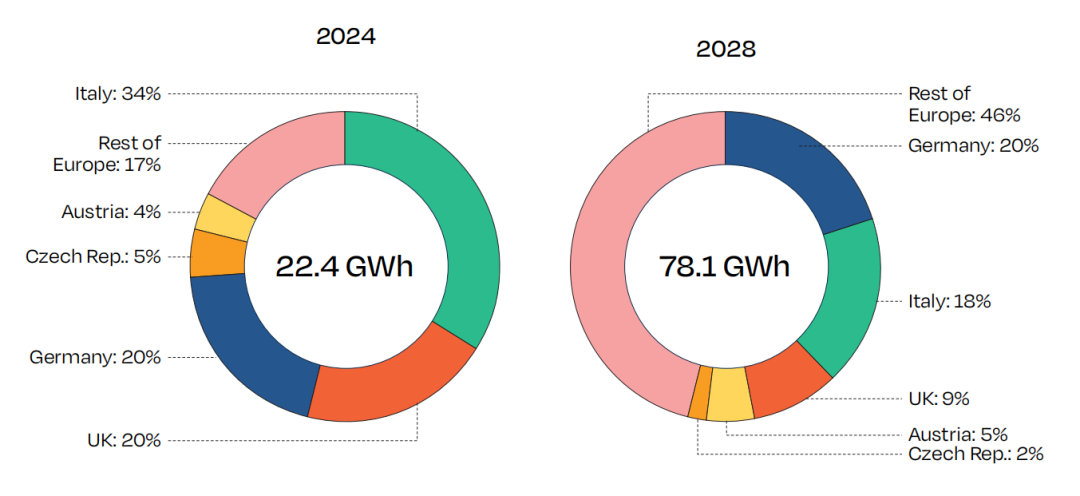

In 2024, Austria added 829 MWh of installed capacity, a 19% decrease compared to 2023, ranking 5th in Europe!

01 Policy-Driven Market

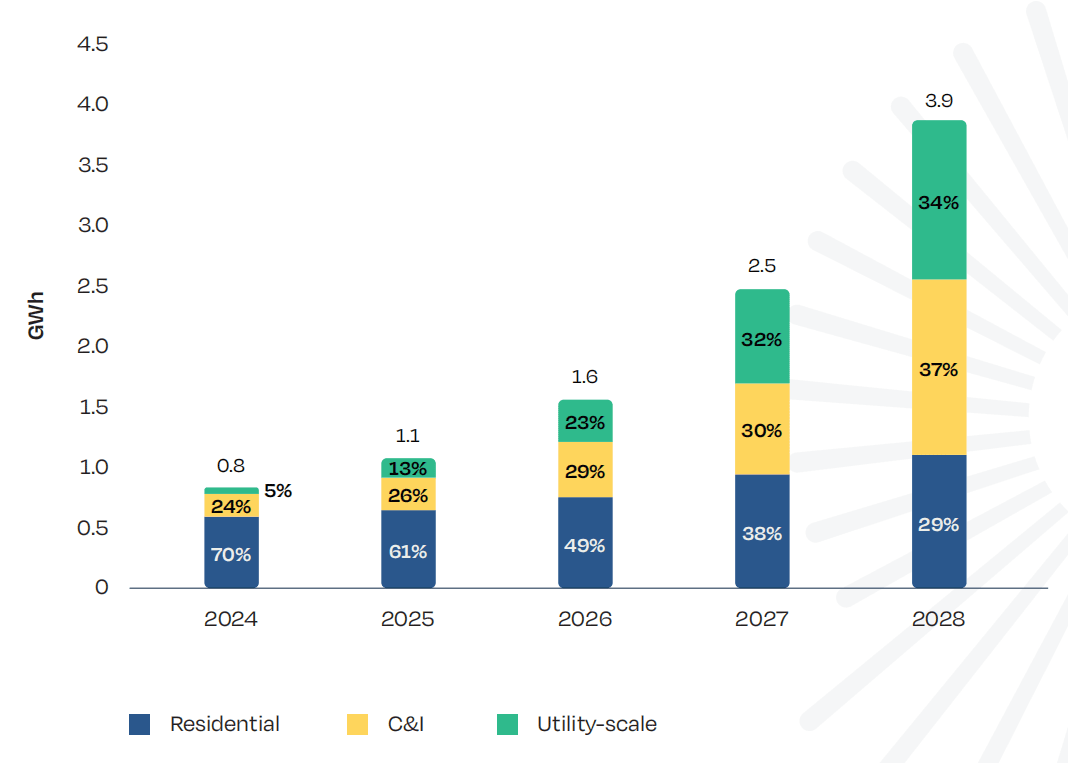

Austria is a “small but beautiful” energy storage market, with residential and commercial storage systems dominating the sector. In 2024, residential storage capacity reached 560 MWh, accounting for 70% of the total, while commercial storage capacity stood at 190 MWh, making up 24%. Together, the two categories accounted for 94%.

The residential and commercial storage markets in Austria are policy-driven, with market fluctuations largely determined by policy changes.

Last year, there were two major solar storage subsidy programs: KLIEN and ÖMAG. ÖMAG subsidized 31,000 energy storage systems at a rate of 200 EUR/kWh. Since ÖMAG’s funding was expected to run out in 2023, KLIEN was introduced as a supplement to ÖMAG. KLIEN provided subsidies for new energy storage system installations at the same rate. Driven by these subsidies, Austria installed over 750 MWh of energy storage systems.

This year, there have been significant changes in fiscal policy. Starting in 2024, new programs have replaced both ÖMAG and KLIEN. However, only batteries that are used for storing surplus photovoltaic (PV) generation (and not batteries paired with PV systems that do not receive VAT exemptions or funding under the EEG (Renewable Energy Expansion) Act) will be subsidized. Batteries with capacities between 4-50 kWh can receive a unified subsidy of 200 EUR/kWh, but the batteries can only be used for storing excess solar power. By May 2024, the 35 million EUR budget for this program had already been exhausted.

ÖMAG played a crucial role in Austria’s solar storage market, enabling over 2 GW of photovoltaic systems to receive tax rebates. Currently, Austria has stopped ÖMAG and introduced a new VAT exemption mechanism. PV systems with a capacity under 35 kW can now be exempt from VAT. This was expected to have a positive impact on the market, as there is no longer a budget cap, and the final discount is similar to the one under ÖMAG. However, policy changes often have negative short-term effects, as users need time to adapt to the new regulations. This is one of the reasons behind the market decline in 2024.

02 The big reserve is temporarily “playing sauce”.

Austria’s big storage market is growing slowly. Last year marked a milestone, with Austria deploying the largest energy storage system ever – but only 21 MWh. For now, the market remains small, with less than 40 MWh of installed capacity in 2024, representing only 5% of the energy storage market.

However, as the share of renewable energy generation increases, electrification accelerates and conventional energy sources are phased out, Austria will need a large number of energy storage systems to maintain grid stability. The regulatory framework has also been established through the Electricity Act, and it is expected that by 2028, Austria’s large storage will grow to 1.32GWh, accounting for 34% of the energy storage market, a triad with household storage and commercial and industrial storage.

03 Vision 2025

Austria accounts for 4% of the overall European energy storage market in 2024. Looking forward to 2025, overall growth is expected to be 37%, with an installed capacity of 1.1 GWh. of this, household storage is projected to be installed at 670 MWh, a small increase, accounting for 61% of the total. Commercial and industrial storage 280 MWh, steady growth. Large storage will triple to 140 MWh, accounting for 13% of the total.

By 2028, it is expected that the “pie will get bigger” thanks to commercial and industrial storage and large storage. Austrian energy storage market to reach 3.9 GWh, 5% of new installations in Europe

In 2024, Austria adds 829 MWh of new installations, a 19% decrease from 2023 and the fifth highest in Europe!