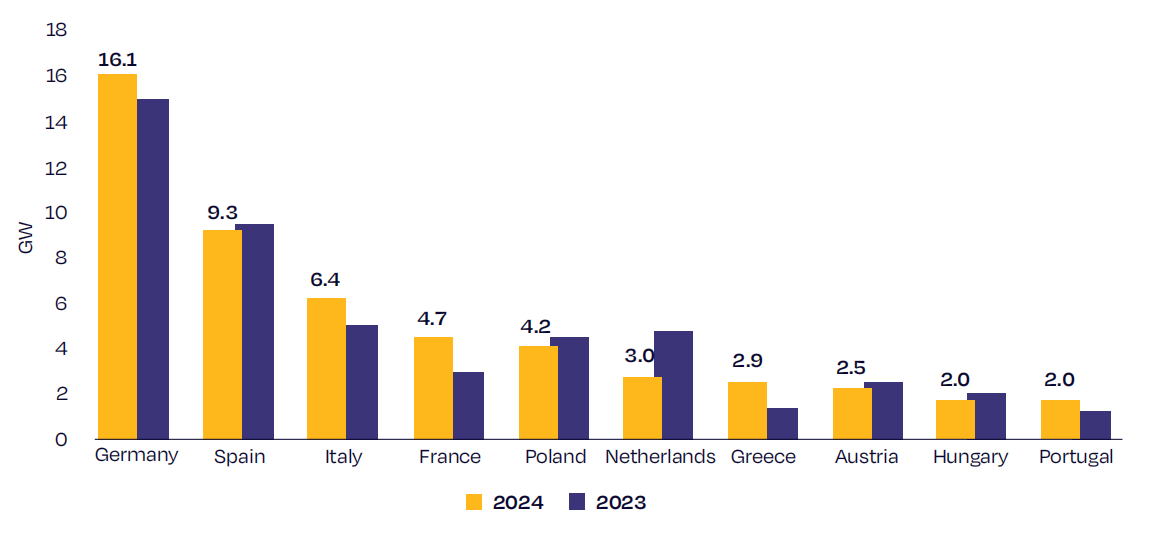

The top ten countries accounted for 87% of the total installed capacity in the European solar energy market in 2024, while the remaining 17 countries made up only 13%.

01 The top ten rankings have become increasingly competitive, driving new records

he top ten ranking has remained relatively stable compared to last year. Germany, Spain, and Italy continued to dominate the top three positions. However, there were two new entrants: Greece at the seventh spot and Portugal at the tenth, replacing Sweden and Belgium. The top ten countries and their respective installed capacities in 2024 are as follows:

The 2024 rankings saw a significant increase in the bar for entry, with all top ten countries surpassing 2.0 GW of installed capacity, compared to 1.5 GW in the previous year. Furthermore, 16 EU member states achieved over 1 GW of new installations, marking a record high and expanding the GW-scale market by two countries.

02 Significant growth variations

While the top ten rankings remained consistent, the growth dynamics within this group have shifted dramatically. In contrast to 2023 and 2022, when all countries experienced growth except for France, only five countries demonstrated positive year-on-year growth in 2024.

Several European countries experienced a decline in solar installations in 2024, including Spain, Poland, the Netherlands, Austria, and Hungary. While broader market factors played a role, inconsistent policymaking was a primary driver. Policymakers in these countries failed to provide a stable regulatory environment, deterring investments in solar energy.

The Netherlands saw the most significant decline, with installations dropping by 1.8 GW to 3 GW in 2024. This was largely due to uncertainties surrounding the future of net metering. In November 2024, the Dutch parliament agreed to phase out net metering by 2027, but the replacement policy remains unclear.

Spain’s rooftop solar market contracted by 17%, contributing to a 400 MW decline in total installations. The depletion of subsidy funds and the normalization of electricity prices dampened growth in this segment.

Poland experienced a 500 MW decrease. The residential solar market continued to decline following the transition from net metering to net billing in 2023. Meanwhile, large-scale solar projects faced grid connection challenges, slowing down installations.

Austria saw a 400 MW decline, primarily driven by a decrease in commercial and industrial solar installations. Inflation, falling electricity prices, and economic pressures led many companies to cut back on solar projects.

Hungary experienced the smallest decline. However, the rooftop solar market was significantly impacted by the transition from net metering to net billing and low electricity prices.

Among the countries that achieved growth, only France, Greece, Italy, and Germany added more than 1 GW of new capacity. France led with 1.5 GW, followed by Greece with 1.3 GW, and Italy and Germany with 1.1 GW and 1 GW, respectively.

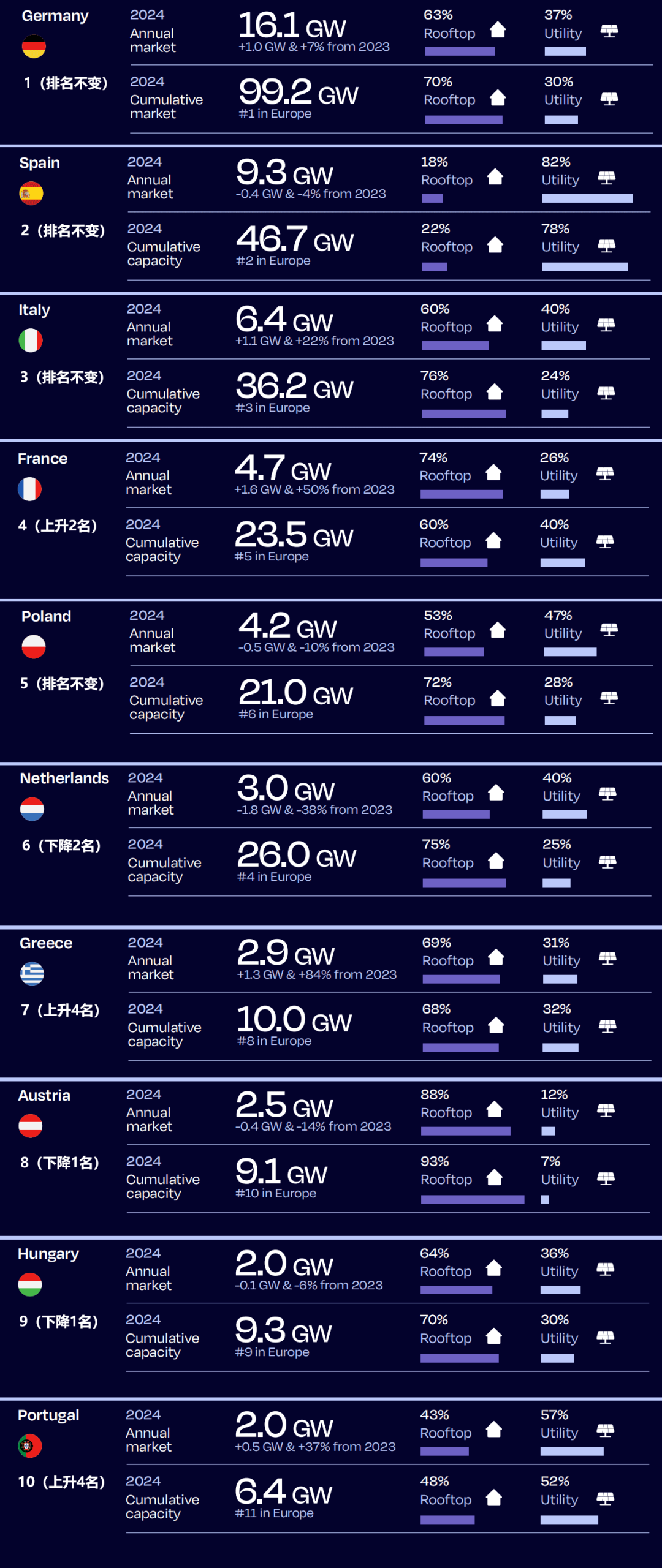

03 Top 10 Overview

The following table summarizes the performance of the top 10 markets in 2024:

The European solar energy market is highly concentrated, with the top ten countries representing 87% of total installations in 2024, leaving just 13% for the remaining 17 countries.